How much money can you withdraw at the end of each month for the next 20 years?ĥ. The higher the interest, the faster your money grows.Ĭonsider an annuity with an annual interest rate of 6% and a present value of $83,748.46 (purchase value).

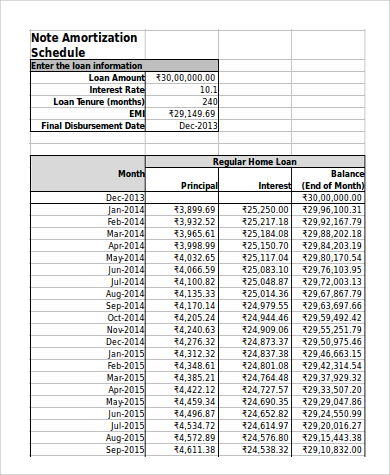

The PMT function below calculates the annual deposit.Įxplanation: in 10 years time, you pay 10 * $100 (negative) = $1000, and you'll receive $1,448.66 (positive) after 10 years. How much money should you deposit at the end of each year to have $1,448.66 in the account in 10 years?Ĥ. Note: we make monthly payments, so we use 6%/12 = 0.5% for Rate and 20*12 = 240 for Nper (total number of periods).Ĭonsider an investment with an annual interest rate of 8% and a present value of 0. The PMT function below calculates the monthly payment. Note: we make quarterly payments, so we use 6%/4 = 1.5% for Rate and 20*4 = 80 for Nper (total number of periods).ģ. The PMT function below calculates the quarterly payment.

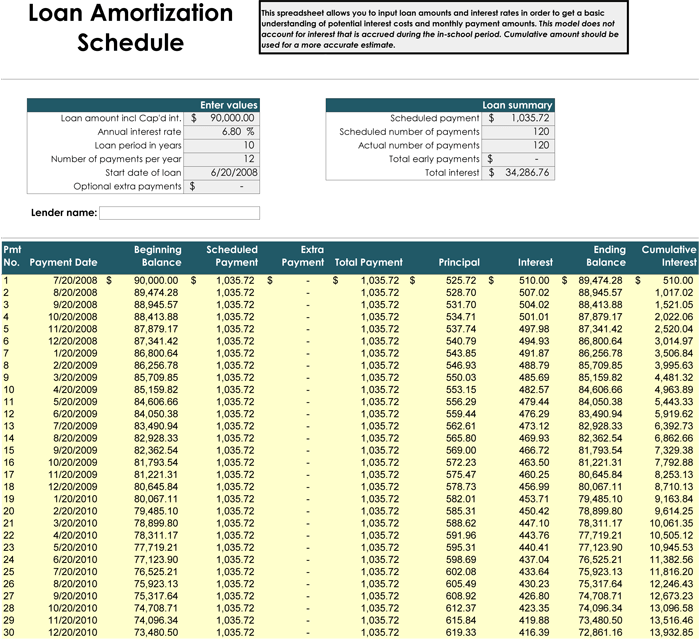

We pay off a loan of $150,000 (positive, we received that amount) and we make annual payments of $13,077.68 (negative, we pay).Ģ. Note: if the fifth argument is omitted, it is assumed that payments are due at the end of the period.

0 kommentar(er)

0 kommentar(er)